Introduction

Scroll down for code samples, example requests and responses. Select a language for code samples from the tabs above or the mobile navigation menu.

TMX Analytics API offers access to trades, quotes, order book and FX datasets. These analytics-ready datasets span multiple geographical locations including Canada and US. These are RESTful APIs that return JSON-encoded responses and standard HTTP response codes.

API Versioning

APIs will be versioned on a single-digit versioning pattern, for example v1, v2, etc. When a new version for an API is available (say v2), the older version (say v1) will be supported for an year before it is phased out.

Example of changes that lead to version change

- A change in the response type (i.e. changing an integer to a float)

- Change in the name of the response attribute (or column name)

- Removal of a response attribute (or column)

Example of changes that do not lead to version change

- Fixing functional bugs

- Security fixes

- Addition of a new response attribute (or column)

- Addition of new web-hook events

- Changing the order of existing attributes

Attribution

Attribution is required for all users. It is as simple as putting “Data provided by TMX Analytics” somewhere on your site or app and linking that text to https://www.tmx.com/analytics. In case of limited screen space, or design constraints, the attribution link can be included in your terms of service using the following hyperlinked text: Data provided by TMX Analytics

API Basics

API Base

Base URL for the API is: https://analyticsapi.tmxanalytics.com

Header Request Parameters

| Parameter | Required | Value |

|---|---|---|

| Content-Type | true | application/json |

Steps to access APIs

In order to access the APIs, the user needs:

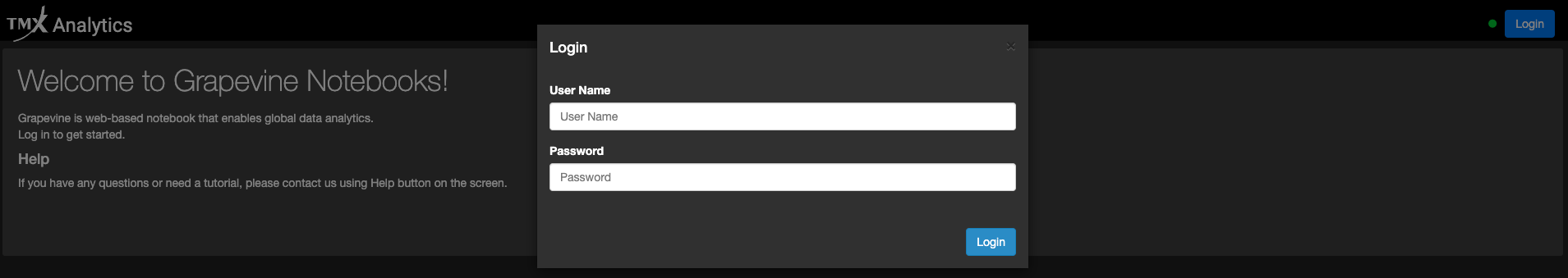

- username - Registered email ID

- password - As set by the user during activation process

- x-api-key - Generated from the TMX Analytics Hub post activation

Steps to Access APIs:

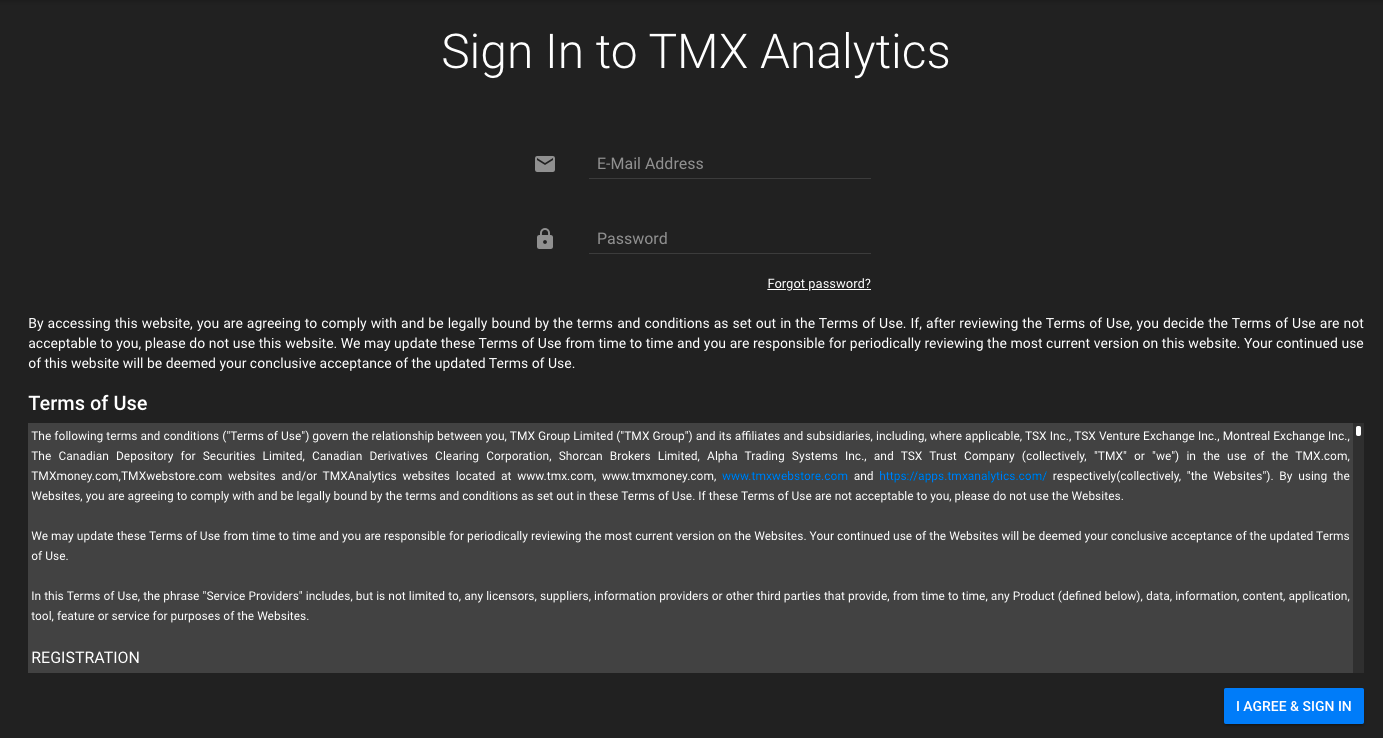

Step 1 - Register User

- Register using hub.tmxanalytics.com or contact datasupport@tmx.com

Step 2 - Set Password

- User receives a Welcome email from datasupport@tmx.com that includes an account activation link

- User generates the password during the activation link

Step 3 - Generate and use bearer token

- Generate API token using username and password via Access API --> Authenticate API (https://analyticsapi.tmxanalytics.com/v1/authn)

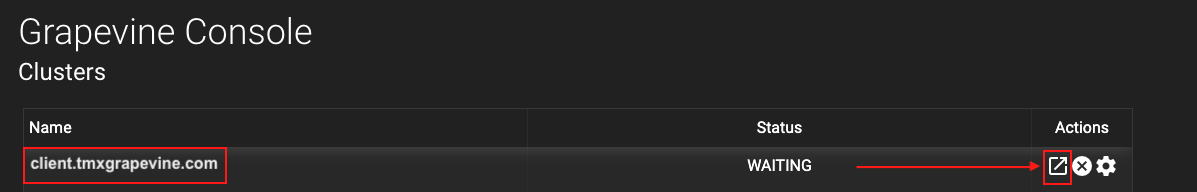

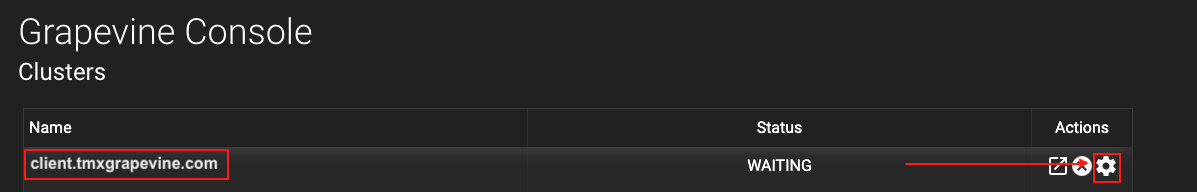

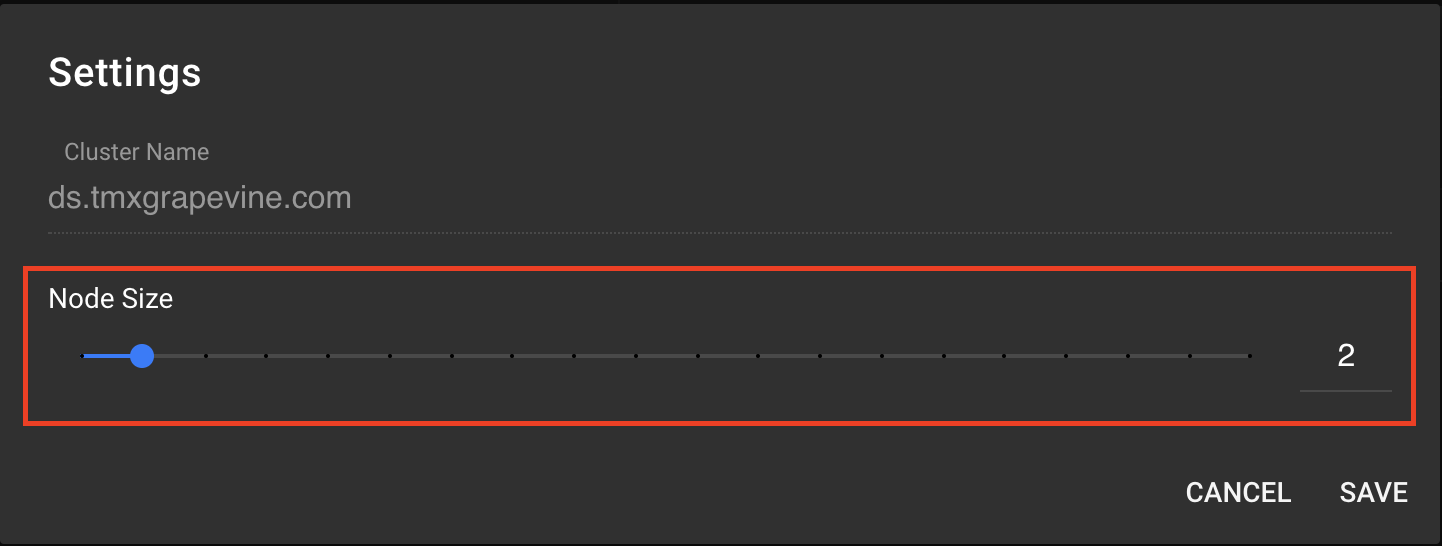

Step 4 - Generate x-api-key

- Login to hub.tmxanalytics.com/login --> API Usage tab --> Enter Password in text field to generate x-api-key

Step 5 - Access the APIs

- Use the bearer API token and x-api-key to access the APIs

Safeguard API Authorization Tokens:

- Confidentiality: Treat tokens as highly confidential and store them securely.

- Validity: Be aware that tokens are valid for one hour only.

- Monitoring and Rotation: Monitor API usage for any anomalies or unauthorized activity. Should any suspicious usage be detected, immediately rotate the API Authorization token.

Change user password

Methods to change user password:

- Through API - Change Password API is available under Access APIs --> Change Password

- Through hub.tmxanalytics.com - Using Change Password menu options in top-right corner

- Through Support - Contact datasupport@tmx.com

Data Sources

Multiple

Query Parameters

- Parameter values are case sensitive. For example, "symbol" : "ABC" is correct and "symbol" : "abc" will not return the expected result

- Parameter values must be comma-delimited within square brackets (array) when requesting multiple. For example, "symbols" : ["ABC","DEF"]

- Parameters passed must be url-encoded. For example, ?symbols=ABC+DEF encoded is ?symbols=ABC%20DEF

Data Formats

TMX Analytics APIs return data in JSON format.

Response Attributes

Error Response

{

"message": "string"

}

API response is documented along with each API endpoint. Response attributes are case-sensitive.

TMX Analytics uses HTTP response codes to indicate the success or failure of an API request. Error response will be accompanied with a detailed message within the body. List of error codes along with the messages are explained in section Errors.

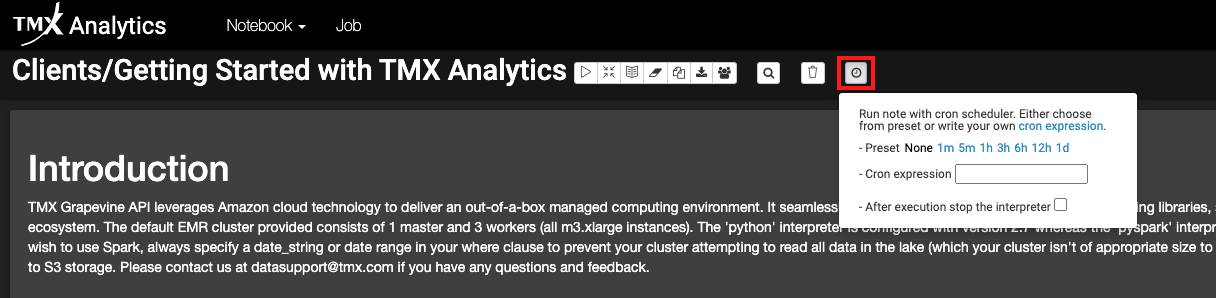

Data Schedule

T-1 data will be available through the APIs by 6:30am EST from Tuesday to Friday.

For example, data for trading activity that occurred on January 15, 2020 will be available by 6:30am on January 16, 2020. Friday's data will be made available the following Monday.

Exception: In case of MX Analytics API, data will be available by 9:00am EST the following day from Tuesday to Friday.

Data Availability API available under Access APIs --> Data Availability can be used to check when the most recent data was loaded for each API.

Subscription Plans & Limits

The limits are applicable per group per plan.

| Group Name | API Description | API Name | Plan | Monthly Call Limit | Symbol Coverage | Lookback Days |

|---|---|---|---|---|---|---|

| Equity Intraday Trades | One-minute Bars for Trades (Canada) | Trades - 1min CA | Free | 100,000 | 50 | Current-30 |

| One-second Bars for Trades (Canada) | Trades - 1sec CA | |||||

| One-minute Bars for Trades (US) | Trades - 1min US | |||||

| One-second Bars for Trades (US) | Trades - 1sec US | |||||

| OHLC (Canada) | OHLC CA | |||||

| Equity Intraday Trades | One-minute Bars for Trades (Canada) | Trades - 1min CA | Starter | 500,000 | 100 | Current-30 |

| One-second Bars for Trades (Canada) | Trades - 1sec CA | |||||

| One-minute Bars for Trades (US) | Trades - 1min US | |||||

| One-second Bars for Trades (US) | Trades - 1sec US | |||||

| OHLC (Canada) | OHLC CA | |||||

| Equity Intraday Trades | One-minute Bars for Trades (Canada) | Trades - 1min CA | Premium | 2,000,000 | ALL | Previous 5 year History |

| One-second Bars for Trades (Canada) | Trades - 1sec CA | |||||

| One-minute Bars for Trades (US) | Trades - 1min US | |||||

| One-second Bars for Trades (US) | Trades - 1sec US | |||||

| OHLC (Canada) | OHLC CA | |||||

| Equity Intraday Quotes | One-minute Bars for Quotes (Canada) | Quotes - 1min CA | Starter | 500,000 | 100 | Current-30 |

| One-second Bars for Quotes (Canada) | Quotes - 1min US | |||||

| One-minute Bars for Quotes (US) | Quotes - 1sec US | |||||

| One-second Bars for Quotes (US) | Quotes - 1sec US | |||||

| Equity Intraday Quotes | One-minute Bars for Quotes (Canada) | Quotes - 1min CA | Premium | 2,000,000 | ALL | Previous 5 year History |

| One-second Bars for Quotes (Canada) | Quotes - 1sec CA | |||||

| One-minute Bars for Quotes (US) | Quotes - 1sec US | |||||

| One-second Bars for Quotes (US) | Quotes - 1sec CA | |||||

| Trades & Quotes Tick Data | Premium Trades and Quotes CBBO (Canada) | TAQ NBBO CA | Premium | 5,000 | ALL | Current-30 |

| Premium Trades and Quotes CBBO (US) | TAQ NBBO US | |||||

| Essential Analytics for Options & Futures | MX Daily Stats | MX Daily Stats CA | Premium | 100,000 | ALL | Previous 5 year History |

| Corporate Actions & Reference Data | Issuers CA | Issuers CA | Premium | 100,000 | ALL | Previous 5 year History |

| Global Symbols | Global Symbols | |||||

| Global Symbols Delta | Global Symbols Delta | |||||

| Essential Analytics for Equities | Advanced Daily Stats (Canada) | Advanced Daily Stats CA | Premium | 100,000 | ALL | Previous 5 year History |

| Liquidity Analytics (Canada) | Liquidity Analytics (CA) | |||||

| Basic Daily Stats (Canada) | Basic Daily Stats CA | |||||

| Daily Stats (Canada) | Daily Stats CA | |||||

| TSX Daily Stats (Canada) | TSX Daily Stats CA | |||||

| Advanced Daily Stats (US) | Advanced Daily Stats US | |||||

| Daily Stats (US) | Daily Stats US | |||||

| Basic Daily Stats (US) | Basic Daily Stats US | |||||

| Broker Analytics | Broker Liquidity(Canada) | Broker Liquidity CA | Premium | 100,000 | ALL | Previous 5 year History |

| Broker Daily Stats(Canada) | Broker Daily Stats CA | |||||

| Broker Summary(Canada) | Broker Summary CA |

Overage charge will be attributable once monthly call limits per plan are exhausted. Notification will be sent on exhaustion of 50%, 75% and 100% monthly call limit. API does not throw any error in such a scenario.

Symbol List

Some of the subscription plans provide a limited number of symbols that can be accessed by the APIs. The list underneath details the symbols included in the Free as well as Starter Plans for Canada and US.

Canada

| Ticker | Free Plan | Starter Plan |

|---|---|---|

| ABX | ✔ | ✔ |

| AC | ✔ | ✔ |

| ACB | ✔ | ✔ |

| AEM | ✔ | ✔ |

| ALA | ✘ | ✔ |

| APHA | ✔ | ✔ |

| AQN | ✘ | ✔ |

| ARX | ✘ | ✔ |

| ATD.B | ✔ | ✔ |

| BAM.A | ✔ | ✔ |

| BBD.B | ✘ | ✔ |

| BCE | ✔ | ✔ |

| BHC | ✘ | ✔ |

| BIP.UN | ✘ | ✔ |

| BMO | ✔ | ✔ |

| BNS | ✔ | ✔ |

| BPY.UN | ✘ | ✔ |

| BTO | ✘ | ✔ |

| CAE | ✘ | ✔ |

| CAR.UN | ✘ | ✔ |

| CCL.B | ✘ | ✔ |

| CCO | ✘ | ✔ |

| CM | ✔ | ✔ |

| CNQ | ✔ | ✔ |

| CNR | ✔ | ✔ |

| CP | ✔ | ✔ |

| CPG | ✘ | ✔ |

| CRON | ✘ | ✔ |

| CSU | ✔ | ✔ |

| CTC.A | ✔ | ✔ |

| CVE | ✔ | ✔ |

| DGC | ✘ | ✔ |

| DOL | ✔ | ✔ |

| ECA | ✔ | ✔ |

| EMA | ✔ | ✔ |

| EMP.A | ✘ | ✔ |

| ENB | ✔ | ✔ |

| FFH | ✘ | ✔ |

| FM | ✔ | ✔ |

| FNV | ✔ | ✔ |

| FTS | ✔ | ✔ |

| G | ✘ | ✔ |

| GIB.A | ✔ | ✔ |

| GIL | ✘ | ✔ |

| GOOS | ✘ | ✔ |

| GWO | ✘ | ✔ |

| H | ✘ | ✔ |

| HEXO | ✘ | ✔ |

| HOD | ✘ | ✔ |

| HOU | ✘ | ✔ |

| HSE | ✘ | ✔ |

| HXT | ✘ | ✔ |

| IFC | ✔ | ✔ |

| IMO | ✘ | ✔ |

| IPL | ✔ | ✔ |

| K | ✘ | ✔ |

| KEY | ✘ | ✔ |

| KL | ✔ | ✔ |

| L | ✔ | ✔ |

| LUN | ✘ | ✔ |

| MEG | ✘ | ✔ |

| MFC | ✔ | ✔ |

| MG | ✔ | ✔ |

| MRU | ✘ | ✔ |

| NA | ✔ | ✔ |

| NTR | ✔ | ✔ |

| OTEX | ✘ | ✔ |

| PKI | ✘ | ✔ |

| POW | ✔ | ✔ |

| PPL | ✔ | ✔ |

| PSA | ✘ | ✔ |

| PWF | ✘ | ✔ |

| QBR.B | ✘ | ✔ |

| QSR | ✔ | ✔ |

| RCI.B | ✔ | ✔ |

| REI.UN | ✘ | ✔ |

| RY | ✔ | ✔ |

| SAP | ✘ | ✔ |

| SHOP | ✔ | ✔ |

| SJR.B | ✘ | ✔ |

| SLF | ✔ | ✔ |

| SNC | ✘ | ✔ |

| SU | ✔ | ✔ |

| T | ✔ | ✔ |

| TD | ✔ | ✔ |

| TECK.B | ✔ | ✔ |

| TRI | ✔ | ✔ |

| TRP | ✔ | ✔ |

| VET | ✘ | ✔ |

| WCN | ✔ | ✔ |

| WEED | ✔ | ✔ |

| WFT | ✘ | ✔ |

| WJA | ✘ | ✔ |

| WN | ✘ | ✔ |

| WPM | ✔ | ✔ |

| XIC | ✘ | ✔ |

| XIU | ✔ | ✔ |

| XSP | ✘ | ✔ |

| ZEB | ✘ | ✔ |

| ZSP | ✘ | ✔ |

US

| Ticker | Free Plan | Starter Plan |

|---|---|---|

| AAPL | ✔ | ✔ |

| ABBV | ✘ | ✔ |

| ADBE | ✘ | ✔ |

| AGG | ✘ | ✔ |

| AGN | ✘ | ✔ |

| AMD | ✔ | ✔ |

| AMGN | ✘ | ✔ |

| AMZN | ✔ | ✔ |

| AVGO | ✘ | ✔ |

| BA | ✔ | ✔ |

| BABA | ✔ | ✔ |

| BAC | ✔ | ✔ |

| BKNG | ✘ | ✔ |

| BMY | ✘ | ✔ |

| BRK/B | ✘ | ✔ |

| C | ✔ | ✔ |

| CAT | ✘ | ✔ |

| CELG | ✘ | ✔ |

| CMCSA | ✘ | ✔ |

| CRM | ✘ | ✔ |

| CSCO | ✔ | ✔ |

| CVS | ✘ | ✔ |

| CVX | ✘ | ✔ |

| DHR | ✘ | ✔ |

| DIA | ✘ | ✔ |

| DIS | ✔ | ✔ |

| EEM | ✔ | ✔ |

| EFA | ✔ | ✔ |

| EWZ | ✔ | ✔ |

| FB | ✔ | ✔ |

| FXI | ✔ | ✔ |

| GDX | ✔ | ✔ |

| GDXJ | ✔ | ✔ |

| GE | ✘ | ✔ |

| GLD | ✔ | ✔ |

| GOOG | ✔ | ✔ |

| GOOGL | ✔ | ✔ |

| GS | ✘ | ✔ |

| HD | ✔ | ✔ |

| HYG | ✔ | ✔ |

| IBM | ✘ | ✔ |

| IEMG | ✘ | ✔ |

| INTC | ✔ | ✔ |

| IVV | ✔ | ✔ |

| IWM | ✔ | ✔ |

| IYR | ✘ | ✔ |

| JNJ | ✔ | ✔ |

| JNK | ✘ | ✔ |

| JPM | ✔ | ✔ |

| KO | ✘ | ✔ |

| LLY | ✘ | ✔ |

| LQD | ✔ | ✔ |

| MA | ✔ | ✔ |

| MCD | ✘ | ✔ |

| MDT | ✘ | ✔ |

| MMM | ✘ | ✔ |

| MRK | ✘ | ✔ |

| MSFT | ✔ | ✔ |

| MU | ✔ | ✔ |

| NFLX | ✔ | ✔ |

| NKE | ✘ | ✔ |

| NOW | ✘ | ✔ |

| NVDA | ✔ | ✔ |

| ORCL | ✘ | ✔ |

| PEP | ✘ | ✔ |

| PFE | ✔ | ✔ |

| PG | ✔ | ✔ |

| PYPL | ✘ | ✔ |

| QCOM | ✔ | ✔ |

| QQQ | ✔ | ✔ |

| ROKU | ✔ | ✔ |

| SBUX | ✘ | ✔ |

| SHOP | ✘ | ✔ |

| SMH | ✘ | ✔ |

| SPY | ✔ | ✔ |

| SQ | ✘ | ✔ |

| T | ✔ | ✔ |

| TLT | ✔ | ✔ |

| TQQQ | ✔ | ✔ |

| TSLA | ✔ | ✔ |

| TWTR | ✘ | ✔ |

| TXN | ✘ | ✔ |

| UNH | ✔ | ✔ |

| UNP | ✘ | ✔ |

| V | ✔ | ✔ |

| VOO | ✘ | ✔ |

| VWO | ✘ | ✔ |

| VXX | ✘ | ✔ |

| VZ | ✘ | ✔ |

| WFC | ✔ | ✔ |

| WMT | ✘ | ✔ |

| XLE | ✘ | ✔ |

| XLF | ✔ | ✔ |

| XLI | ✘ | ✔ |

| XLK | ✔ | ✔ |

| XLP | ✘ | ✔ |

| XLU | ✔ | ✔ |

| XLV | ✔ | ✔ |

| XOM | ✔ | ✔ |

| XOP | ✘ | ✔ |

Billing

Clients will receive a monthly bill and invoice statement at the end of the month. For example, Invoice for API usage in September will be made available in November.

Google Sheets Add-on for APIs

🛠️ Note: This application is under construction and will be available soon.

Excel Spreadsheet plugin for APIs

🛠️ Note: This application is under construction and will be available soon.

Access APIs

Authenticate

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'x-api-key': 'API_KEY'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/authn', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/authn");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/authn \

-H 'Content-Type: application/json' \

-H 'x-api-key: API_KEY'

const inputBody = '{

"email": "string",

"password": "string"

}';

const headers = {

'Content-Type':'application/json',

'x-api-key':'API_KEY'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/authn',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/authn

Allows users to generate the API Authorization token by passing valid user credentials

Body parameter

{

"email": "string",

"password": "string"

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | authenticateRequestv1 | true | none |

| body | string | true | User email as registered with TMX Analytics | |

| password | body | string | true | User password |

Example responses

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | None |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 424 | Failed Dependency | 424 response | None |

| 500 | Internal Server Error | 500 response | None |

Change Password

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/changepassword', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/changepassword");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/changepassword \

-H 'Content-Type: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"confirmPassword": "string",

"email": "string",

"newPassword": "string",

"oldPassword": "string"

}';

const headers = {

'Content-Type':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/changepassword',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/changepassword

Allows users to change the password

Body parameter

{

"confirmPassword": "string",

"email": "string",

"newPassword": "string",

"oldPassword": "string"

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | changePasswordRequestv1 | true | none |

| confirmPassword | body | string | true | Re-enter new password |

| body | string | true | User Email Id | |

| newPassword | body | string | true | New password must be at least 8 characters in length or longer and must contain 1 lowercase alphabetical character, 1 uppercase alphabetical character, 1 numeric character, one special character |

| oldPassword | body | string | true | Old password |

Example responses

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | None |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 424 | Failed Dependency | 424 response | None |

| 500 | Internal Server Error | 500 response | None |

Data Availability

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/dataavailability', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/dataavailability");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/dataavailability \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"apiName": [

"OHLC CA"

],

"pageafter": 0

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/dataavailability',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/dataavailability

Provides the most recent business date for which data is available within each API

Body parameter

{

"apiName": [

"OHLC CA"

],

"pageafter": 0

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | dataavailabilityCaRequestv1 | true | none |

| apiName | body | [string] | true | Name of specific API or "all" |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

Enumerated Values

| Parameter | Value |

|---|---|

| apiName | OHLC CA |

| apiName | Broker Liquidity CA |

| apiName | Trades - 1min CA |

| apiName | Trades - 1sec CA |

| apiName | Trades - 1min US |

| apiName | Investor Flows CA |

| apiName | Quotes - 1min CA |

| apiName | Quotes - 1sec CA |

| apiName | Quotes - 1min US |

| apiName | Quotes - 1sec US |

| apiName | TAQ NBBO CA |

| apiName | TAQ NBBO US |

| apiName | Advanced Daily Stats CA |

| apiName | Advanced Daily Stats US |

| apiName | Basic Daily Stats CA |

| apiName | Basic Daily Stats US |

| apiName | Daily Stats CA |

| apiName | Daily Stats US |

| apiName | Global Symbols |

| apiName | Global Symbols Delta |

| apiName | Issuers |

| apiName | MX Daily Stats |

| apiName | Liquidity Analytics CA |

| apiName | TSX/V Daily Stats |

| apiName | Broker Summary CA |

| apiName | all |

Example responses

200 Response

{

"data": [

{

"apiName": "string",

"lastLoadDate": "string"

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | dataavailabilityCaResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Forgot Password

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/forgotpassword', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/forgotpassword");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/forgotpassword \

-H 'Content-Type: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"email": "string"

}';

const headers = {

'Content-Type':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/forgotpassword',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/forgotpassword

Sends a reset password email to the user

Body parameter

{

"email": "string"

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | forgotPasswordRequestv1 | true | none |

| body | string | true | Email for forgot password |

Example responses

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | None |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Revoke Token

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/revoke', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/revoke");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/revoke \

-H 'Content-Type: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"token": "string",

"type": "string"

}';

const headers = {

'Content-Type':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/revoke',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/revoke

Revokes the token for the user

Body parameter

{

"token": "string",

"type": "string"

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | revokeRequestv1 | true | none |

| token | body | string | true | access_token or refresh_token value that needs to be revoked |

| type | body | string | true | access_token or refresh_token |

Example responses

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | None |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Essential Analytics for Equities

Advanced Daily Stats CA

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/ca/advanceddailystats', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/ca/advanceddailystats");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/ca/advanceddailystats \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/ca/advanceddailystats',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/ca/advanceddailystats

Contains advanced daily statistics such as seconday close price, avgerage top of the book bid/ask volume, quoted spreads, effective spreads and trading volumes/count/value metrics across Canadian and US venues. Metrics pertaining to Canada - Covers trading activity across all Canadian marketplaces. Symbol coverage extends to all Canadian symbols as well.

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | advanceddailystatsCaRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST till when the data is required. For eg. end date of 2020-09-31 will include data from startdate to 2020-09-31 |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Starting date in EST from when the data is required. For eg. startdate of 2020-09-01 will include data from 2020-09-01 to enddate |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | us_symbol |

| columns | secondaryclose |

| columns | avgbidvol |

| columns | avgaskvol |

| columns | avg_sprd_cent |

| columns | avg_sprd_bps |

| columns | effective_sprd_cent |

| columns | effective_sprd_bps |

| columns | trade_count_ca |

| columns | daily_volume_ca |

| columns | daily_trading_value_ca |

| columns | trade_count_us |

| columns | daily_volume_us |

| columns | daily_trading_value_us |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"avg_sprd_bps": 0,

"avg_sprd_cent": 0,

"avgaskvol": 0,

"avgbidvol": 0,

"daily_trading_value_ca": 0,

"daily_trading_value_us": 0,

"daily_volume_ca": 0,

"daily_volume_us": 0,

"date_string": "string",

"effective_sprd_bps": 0,

"effective_sprd_cent": 0,

"secondaryclose": 0,

"symbol": "string",

"trade_count_ca": 0,

"trade_count_us": 0,

"us_symbol": "string"

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | advanceddailystatsCaResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Basic Daily Stats CA

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/ca/basicdailystatsall', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/ca/basicdailystatsall");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/ca/basicdailystatsall \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/ca/basicdailystatsall',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/ca/basicdailystatsall

Contains essential daily statistics such as open, high, low, close, trade count aggregations, trade volume aggregations, trade value aggregations, vwap, volatility metrics, shares outstanding and market capitalization. Covers trading activity across all Canadian marketplaces. Symbol coverage extends to all Canadian symbols as well.

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | basicdailystatsallCaRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST till when the data is required. For eg. end date of 2020-09-31 will include data from startdate to 2020-09-31 |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Starting date in EST from when the data is required. For eg. startdate of 2020-09-01 will include data from 2020-09-01 to enddate |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | first_observed_price |

| columns | intraday_high |

| columns | intraday_low |

| columns | last_observed_price |

| columns | london_4pm_price |

| columns | total_trade_count |

| columns | total_daily_volume |

| columns | total_daily_value |

| columns | total_primary_exchange_volume |

| columns | avg_30day_trade_count |

| columns | avg_30day_daily_volume |

| columns | avg_30day_daily_value |

| columns | twap_30day |

| columns | twap_60day |

| columns | volatility30_pct |

| columns | volatility60_pct |

| columns | shares_outstanding |

| columns | mkt_cap |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"avg_30day_daily_value": 0,

"avg_30day_daily_volume": 0,

"avg_30day_trade_count": 0,

"date_string": "string",

"first_observed_price": 0,

"intraday_high": 0,

"intraday_low": 0,

"last_observed_price": 0,

"london_4pm_price": 0,

"mkt_cap": 0,

"shares_outstanding": 0,

"symbol": "string",

"total_daily_value": 0,

"total_daily_volume": 0,

"total_primary_exchange_volume": 0,

"total_trade_count": 0,

"twap_30day": 0,

"twap_60day": 0,

"volatility30_pct": 0,

"volatility60_pct": 0

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | basicdailystatsallCaResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Daily Stats CA

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/ca/dailystats', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/ca/dailystats");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/ca/dailystats \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/ca/dailystats',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/ca/dailystats

Contains daily statistics such as open, high, low, close, total volume, volume_moo, volume_moc, volume_dark, vwap, volatility30_pct, volatility60_pct.Covers trading activity across all Canadian marketplaces. Symbol coverage extends to all Canadian symbols as well.

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | dailystatsCaRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST till when the data is required. For eg. end date of 2020-09-31 will include data from startdate to 2020-09-31 |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Starting date in EST from when the data is required. For eg. startdate of 2020-09-01 will include data from 2020-09-01 to enddate |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | volume_block |

| columns | volume_moo |

| columns | volume_moc |

| columns | volume_odd_lot |

| columns | volume_dark |

| columns | total_adjvolume |

| columns | total_adjvalue |

| columns | total_adjcount |

| columns | intraday_high |

| columns | intraday_low |

| columns | first_observed_price |

| columns | fop_venue |

| columns | fop_time_eastern |

| columns | last_observed_price |

| columns | lop_venue |

| columns | lop_time_eastern |

| columns | avg_advolume30 |

| columns | vwap30 |

| columns | vwap60 |

| columns | intraday_volatility_pct |

| columns | volume_cross |

| columns | volume_pre_market |

| columns | volume_post_market |

| columns | total_trade_count |

| columns | total_daily_volume |

| columns | total_daily_value |

| columns | total_primary_exchange_volume |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"avg_advolume30": 0,

"date_string": "string",

"first_observed_price": 0,

"fop_time_eastern": "string",

"fop_venue": "string",

"intraday_high": 0,

"intraday_low": 0,

"intraday_volatility_pct": 0,

"last_observed_price": 0,

"lop_time_eastern": "string",

"lop_venue": "string",

"symbol": "string",

"total_adjcount": 0,

"total_adjvalue": 0,

"total_adjvolume": 0,

"total_daily_value": 0,

"total_daily_volume": 0,

"total_primary_exchange_volume": 0,

"total_trade_count": 0,

"volume_block": 0,

"volume_cross": 0,

"volume_dark": 0,

"volume_moc": 0,

"volume_moo": 0,

"volume_odd_lot": 0,

"volume_post_market": 0,

"volume_pre_market": 0,

"vwap30": 0,

"vwap60": 0

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | dailystatsCaResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Liquidity Analytics CA

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/ca/liquidityanalytics', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/ca/liquidityanalytics");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/ca/liquidityanalytics \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/ca/liquidityanalytics',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/ca/liquidityanalytics

Provides a market-wide view of the total displayed (onbook) liquidity available by symbol each day at multiple price levels beyond the top of book. The dataset aggregates the consolidated market-wide orderbook to build these calculations and is meant to provide a robust input into assessing market-wide quoted liquidity and determining an appropriate order/trade execution strategy. It can also be used to help detect when material changes occurr to a symbol's liquidity profile

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | liquidityanalyticsCaRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | venue |

| columns | pct_time_bid_10b_deep |

| columns | bidsize10b_impact |

| columns | bidvalue10b_impact |

| columns | pct_time_bid_25b_deep |

| columns | bidsize25b_impact |

| columns | bidvalue25b_impact |

| columns | pct_time_ask_10b_deep |

| columns | asksize10b_impact |

| columns | askvalue10b_impact |

| columns | pct_time_ask_25b_deep |

| columns | asksize25b_impact |

| columns | askvalue25b_impact |

| columns | pct_time_bidask_25k_deep |

| columns | sprd_25k_bps |

| columns | pct_time_bidask_50k_deep |

| columns | sprd_50k_bps |

| columns | pct_time_bidask_100k_deep |

| columns | sprd_100k_bps |

| columns | pct_time_bidask_200k_deep |

| columns | sprd_200k_bps |

| columns | pct_time_bidask_500k_deep |

| columns | sprd_500k_bps |

| columns | pct_time_bidask_1m_deep |

| columns | sprd_1m_bps |

| columns | time_wgt_bidvalue10b_impact_component_score |

| columns | time_wgt_bidvalue25b_impact_component_score |

| columns | time_wgt_askvalue10b_impact_component_score |

| columns | time_wgt_askvalue25b_impact_component_score |

| columns | time_wgt_sprd_25k_bps_component_score |

| columns | time_wgt_sprd_50k_bps_component_score |

| columns | time_wgt_sprd_100k_bps_component_score |

| columns | time_wgt_sprd_200k_bps_component_score |

| columns | time_wgt_sprd_500k_bps_component_score |

| columns | time_wgt_sprd_1m_bps_component_score |

| columns | liquidity_score |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"asksize10b_impact": 0,

"asksize25b_impact": 0,

"askvalue10b_impact": 0,

"askvalue25b_impact": 0,

"bidsize10b_impact": 0,

"bidsize25b_impact": 0,

"bidvalue10b_impact": 0,

"bidvalue25b_impact": 0,

"date_string": "string",

"liquidity_score": 0,

"pct_time_ask_10b_deep": 0,

"pct_time_ask_25b_deep": 0,

"pct_time_bid_10b_deep": 0,

"pct_time_bid_25b_deep": 0,

"pct_time_bidask_100k_deep": 0,

"pct_time_bidask_1m_deep": 0,

"pct_time_bidask_200k_deep": 0,

"pct_time_bidask_25k_deep": 0,

"pct_time_bidask_500k_deep": 0,

"pct_time_bidask_50k_deep": 0,

"sprd_100k_bps": 0,

"sprd_1m_bps": 0,

"sprd_200k_bps": 0,

"sprd_25k_bps": 0,

"sprd_500k_bps": 0,

"sprd_50k_bps": 0,

"symbol": "string",

"time_wgt_askvalue10b_impact_component_score": 0,

"time_wgt_askvalue25b_impact_component_score": 0,

"time_wgt_bidvalue10b_impact_component_score": 0,

"time_wgt_bidvalue25b_impact_component_score": 0,

"time_wgt_sprd_100k_bps_component_score": 0,

"time_wgt_sprd_1m_bps_component_score": 0,

"time_wgt_sprd_200k_bps_component_score": 0,

"time_wgt_sprd_25k_bps_component_score": 0,

"time_wgt_sprd_500k_bps_component_score": 0,

"time_wgt_sprd_50k_bps_component_score": 0,

"venue": "string"

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | liquidityanalyticsCaResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Liquidity Summary CA

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/ca/liquiditysummary', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/ca/liquiditysummary");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/ca/liquiditysummary \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"date_string"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/ca/liquiditysummary',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/ca/liquiditysummary

Contains pre-calculated spread with the following specifications: 1) Metrics are calculated using the consolidated order book from all Canadian venues 2) The bid/ask is calculated as the volume weighted average price that would be realized assuming the execution of a $50,000 marketable sell/buy order 3) The effective spread is calculated at each one-second interval between 9:45 - 15:45 ET 4) The reported average bid-ask spread is computed by taking the time-weighted average of all one second effective spreads for each day. Covers trading activity across all Canadian marketplaces. Symbol coverage extends to all Canadian symbols as well.

Body parameter

{

"columns": [

"date_string"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | liquiditySummaryCaRequest | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST till when the data is required. For eg. end date of 2020-09-31 will include data from startdate to 2020-09-31 |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Starting date in EST from when the data is required. For eg. startdate of 2020-09-01 will include data from 2020-09-01 to enddate |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | date_string |

| columns | symbol |

| columns | spread |

Example responses

200 Response

{

"data": [

{

"date_string": "string",

"spread": 0,

"symbol": "string"

}

]

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | liquiditySummaryCaResponse |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

TSX Daily Stats CA

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/ca/tsxdailystats', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/ca/tsxdailystats");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/ca/tsxdailystats \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"exchange"

],

"enddate": "string",

"exchange": "string",

"pageafter": 0,

"startdate": "string",

"stat": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/ca/tsxdailystats',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/ca/tsxdailystats

Contains premium TSX/V specific daily statistics such as close price, open price, time of price movement extension, time of market state change and time of market imbalance message. Covers trading activity across TSX/TSXV and Alpha. Symbol coverage extends to all TSX/V listed symbols.

Body parameter

{

"columns": [

"exchange"

],

"enddate": "string",

"exchange": "string",

"pageafter": 0,

"startdate": "string",

"stat": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | tsxdailystatsCaRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST till when the data is required. For eg. end date of 2020-09-31 will include data from startdate to 2020-09-31 |

| exchange | body | string | false | Identifies the venue for the applicable statistics |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Starting date in EST from when the data is required. For eg. start date of 2020-09-01 will include data from 2020-09-01 to enddate |

| stat | body | string | true | Identifies the various statistics that can be obtained. Possible values are available in Reference Guide for stat for TSX Daily Stats CA |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Reference Guide for stat for TSX Daily Stats CA

| stat | keyvalue | value | time | value2 | value3 |

|---|---|---|---|---|---|

| ccp | <symbol> |

Close price for symbol on associated exchange | Market close time for symbol on associated exchange | N/A | N/A |

| cop | <symbol> |

Open price for symbol on associated exchange | Market open time for symbol on associated exchange | Boardlot size of symbol | N/A |

| pme | <symbol> |

N/A | Time of price movement extension on associated exchange | N/A | N/A |

| msc | <symbol> |

Market state on associated exchange | Time of market state change on associated exchange | N/A | N/A |

| moc | <symbol> |

Imbalance volume on associated exchange | Time of market imbalance message on associated exchange | Imbalance side on associated exchange | Imbalance price on associated exchange |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | exchange |

| columns | year |

| columns | stat |

| columns | key_value |

| columns | time |

| columns | time_nanos |

| columns | value |

| columns | value2 |

| columns | value3 |

| columns | value4_to_n |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"date_string": "string",

"exchange": "string",

"key_value": "string",

"stat": "string",

"time": "string",

"time_nanos": 0,

"value": "string",

"value2": "string",

"value3": "string",

"value4_to_n": [

"string"

],

"year": "string"

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | tsxdailystatsCaResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Advanced Daily Stats US

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/us/advanceddailystats', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/us/advanceddailystats");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/us/advanceddailystats \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/us/advanceddailystats',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/us/advanceddailystats

Contains advanced daily statistics such as seconday close price, avgerage top of the book bid/ask volume, quoted spreads, effective spreads and trading volumes/count/value metrics across Canadian and US venues. Metrics pertaining to Canada - Covers trading activity across all Canadian marketplaces. Symbol coverage extends to all Canadian symbols as well.

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | advanceddailystatsUsRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | ca_symbol |

| columns | secondaryclose |

| columns | avgbidvol |

| columns | avgaskvol |

| columns | avg_sprd_cent |

| columns | avg_sprd_bps |

| columns | effective_sprd_cent |

| columns | effective_sprd_bps |

| columns | trade_count_ca |

| columns | daily_volume_ca |

| columns | daily_trading_value_ca |

| columns | trade_count_us |

| columns | daily_volume_us |

| columns | daily_trading_value_us |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"avg_sprd_bps": 0,

"avg_sprd_cent": 0,

"avgaskvol": 0,

"avgbidvol": 0,

"ca_symbol": "string",

"daily_trading_value_ca": 0,

"daily_trading_value_us": 0,

"daily_volume_ca": 0,

"daily_volume_us": 0,

"date_string": "string",

"effective_sprd_bps": 0,

"effective_sprd_cent": 0,

"secondaryclose": 0,

"symbol": "string",

"trade_count_ca": 0,

"trade_count_us": 0

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | advanceddailystatsUsResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Basic Daily Stats US

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/us/basicdailystatsall', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/us/basicdailystatsall");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/us/basicdailystatsall \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/us/basicdailystatsall',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/us/basicdailystatsall

Contains essential daily statistics such as open, high, low, close, trade count aggregations, trade volume aggregations, trade value aggregations, vwap, volatility metrics, shares outstanding and market capitalization. Covers trading activity across all US marketplaces. Symbol coverage extends to all US symbols as well.

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | basicdailystatsallUsRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | first_observed_price |

| columns | intraday_high |

| columns | intraday_low |

| columns | last_observed_price |

| columns | london_4pm_price |

| columns | total_trade_count |

| columns | total_daily_volume |

| columns | total_daily_value |

| columns | avg_30day_trade_count |

| columns | avg_30day_daily_volume |

| columns | avg_30day_daily_value |

| columns | TWAP_30day |

| columns | TWAP_60day |

| columns | volatility30_pct |

| columns | volatility60_pct |

| columns | shares_outstanding |

| columns | mkt_cap |

| columns | date_string |

Example responses

200 Response

{

"data": [

{

"avg_30day_daily_value": 0,

"avg_30day_daily_volume": 0,

"avg_30day_trade_count": 0,

"date_string": "string",

"first_observed_price": "string",

"intraday_high": "string",

"intraday_low": "string",

"last_observed_price": "string",

"london_4pm_price": "string",

"mkt_cap": 0,

"shares_outstanding": 0,

"symbol": "string",

"total_daily_value": 0,

"total_daily_volume": 0,

"total_trade_count": 0,

"twap_30day": "string",

"twap_60day": "string",

"volatility30_pct": "string",

"volatility60_pct": "string"

}

],

"pageafter": 0,

"pagebefore": 0

}

Responses

Detailed description of error codes is explained in section Errors.

| Status | Meaning | Description | Schema |

|---|---|---|---|

| 200 | OK | 200 response | basicdailystatsallUsResponsev1 |

| 400 | Bad Request | 400 response | None |

| 401 | Unauthorized | 401 response | None |

| 403 | Forbidden | 403 response | None |

| 500 | Internal Server Error | 500 response | None |

Daily Stats US

Code samples

import requests

headers = {

'Content-Type': 'application/json',

'Accept': 'application/json',

'x-api-key': 'API_KEY',

'Authorization': 'Bearer {access-token}'

}

r = requests.post('https://analyticsapi.tmxanalytics.com/v1/us/dailystats', headers = headers)

print(r.json())

URL obj = new URL("https://analyticsapi.tmxanalytics.com/v1/us/dailystats");

HttpURLConnection con = (HttpURLConnection) obj.openConnection();

con.setRequestMethod("POST");

int responseCode = con.getResponseCode();

BufferedReader in = new BufferedReader(

new InputStreamReader(con.getInputStream()));

String inputLine;

StringBuffer response = new StringBuffer();

while ((inputLine = in.readLine()) != null) {

response.append(inputLine);

}

in.close();

System.out.println(response.toString());

# You can also use wget

curl -X POST https://analyticsapi.tmxanalytics.com/v1/us/dailystats \

-H 'Content-Type: application/json' \

-H 'Accept: application/json' \

-H 'x-api-key: API_KEY' \

-H 'Authorization: Bearer {access-token}'

const inputBody = '{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}';

const headers = {

'Content-Type':'application/json',

'Accept':'application/json',

'x-api-key':'API_KEY',

'Authorization':'Bearer {access-token}'

};

fetch('https://analyticsapi.tmxanalytics.com/v1/us/dailystats',

{

method: 'POST',

body: inputBody,

headers: headers

})

.then(function(res) {

return res.json();

}).then(function(body) {

console.log(body);

});

POST /v1/us/dailystats

Contains daily statistics such as open, high, low, close, total volume, volume_moo, volume_moc, vwap, volatility30_pct, volatility60_pct. Covers trading activity across all US marketplaces. Symbol coverage extends to all US symbols as well

Body parameter

{

"columns": [

"symbol"

],

"enddate": "string",

"pageafter": 0,

"startdate": "string",

"symbols": [

"string"

]

}

Parameters

| Name | In | Type | Required | Description |

|---|---|---|---|---|

| x-api-key | header | string | true | API key to be added in headers for authorization |

| body | body | dailystatsUsRequestv1 | true | none |

| columns | body | [string] | false | Select columns from the enumerated list below can be provided as an array |

| enddate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| pageafter | body | integer | false | Resultset is paginated - mention record offset if data is needed after a specific record |

| startdate | body | string | true | Date in EST for when the data is required. For eg. '2020-09-01' (Due to the volume of the data, select only up to 90 days at a time e.g. 'startdate': '2020-06-01', 'enddate': '2020-08-29') |

| symbols | body | [string] | true | Ticker symbol of the security. For eg. ["AC"] for Air Canada or ["AC", "TD"] for Air Canada and TD or ["ALL_SYMBOLS"] for fetching all the symbols |

Enumerated Values

| Parameter | Value |

|---|---|

| columns | symbol |

| columns | volume_block |

| columns | volume_moo |

| columns | volume_moc |

| columns | volume_odd_lot |

| columns | total_adjvolume |

| columns | total_adjvalue |

| columns | total_adjcount |

| columns | intraday_high |

| columns | intraday_low |

| columns | first_observed_price |

| columns | FOP_venue |

| columns | FOP_time_eastern |

| columns | last_observed_price |

| columns | LOP_venue |

| columns | LOP_time_eastern |

| columns | avg_ADVolume30 |

| columns | vwap30 |

| columns | vwap60 |

| columns | intraday_volatility_pct |

| columns | volume_cross |

| columns | volume_pre_market |

| columns | volume_post_market |

| columns | total_trade_count |

| columns | total_daily_volume |

| columns | total_daily_value |